With the start of 2026, auto insurance shopping in the US remains subject to both seasonal cycles and broader market forces. According to recent industry studies, more than 55% of auto policyholders shopped or compared policies in the past year, the highest level recorded in nearly two decades. Digital activity around auto insurance quotes remains elevated, with consumers initiating and revisiting quotes earlier in their policy lifecycle.

What’s important for carriers is why this intent is rising. The spike is not being driven by a single event like renewal cycles or promotional activity. Instead, it reflects a convergence of pricing volatility, emerging vehicle risk, repair-cost inflation, and growing consumer uncertainty around how auto insurance is being priced in 2026.

This makes early-year demand highly active but also highly uneven in quality.

1. EVs and Advanced Vehicle Tech Are Driving Pricing Uncertainty and Re-Shopping

One of the strongest contributors to early-2026 intent is the growing gap between how vehicles are built and how consumers understand insurance pricing. Insights from S&P Global Mobility show that electrification, advanced driver-assistance systems (ADAS), and sensor-heavy vehicles are materially increasing claims severity and repair variability.

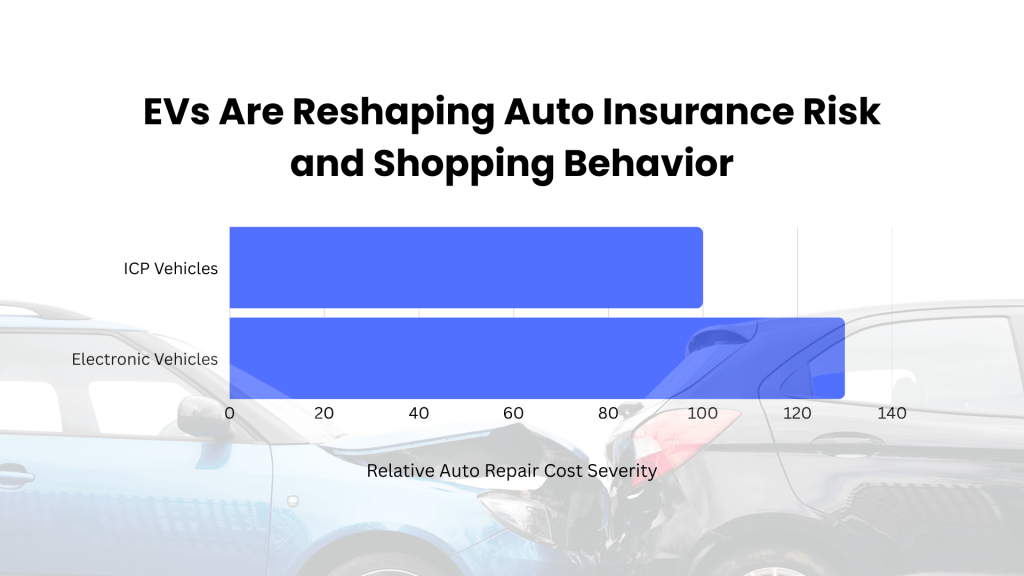

EV repairs now cost 20–30% more on average than comparable ICE vehicles, driven by battery replacement risks, specialized labor, and limited parts availability. Even minor collisions can trigger significant repair bills due to sensor recalibration. For consumers, this translates into premium changes that feel inconsistent and hard to predict.

As a result, EV and newer-vehicle owners are disproportionately active in the market. They are initiating car insurance quotes online not necessarily to switch immediately, but to understand how different carriers are pricing their risk. This cohort shows higher comparison frequency and earlier re-entry into the shopping journey, making them a major contributor to early-year intent spikes.

2. Repair Cost Inflation Is Reshaping How Consumers Judge Fair Pricing

Beyond EVs, broader repair economics are also influencing behavior. US repair costs remain elevated due to labor shortages, higher parts prices, and longer repair cycles. Industry data indicates that average claim severity for personal auto remains well above pre-pandemic levels, even as frequency stabilizes.

Consumers may not track loss ratios, but they feel the downstream impact. Premium increases tied to repair inflation have made drivers far more sensitive to perceived value. Many shoppers are not simply looking for cheaper policies. They are looking for reassurance that their premium aligns with their vehicle, driving behavior and risk profile.

This is why 2026 shoppers are more likely to compare car insurance rates multiple times before committing. Comparison has become a mechanism to validate pricing fairness, not just to find the lowest number.

3. Rate Recalibration Is Pulling Loyal Policyholders Back Into the Market

Another defining feature of early-2026 intent is who is shopping. Data from J.D. Power shows that even traditionally loyal auto insurance customers are increasingly returning to the market to reassess coverage after consecutive years of rate movement.

Many of these shoppers are not new buyers. They are existing policyholders responding to mid-term increases, renewal notices, or visible pricing differences across carriers. This behavior expands the funnel with consumers who have higher expectations, stronger coverage awareness, and lower tolerance for friction.

For carriers, this means early-year intent is coming from higher-value segments, but with more scrutiny attached.

4. Digital Shopping Has Shifted from Instant Decision to Extended Evaluation

While digital adoption has accelerated, decision-making has slowed. Shoppers expect speed, clarity, and transparency, but they are also taking more time to decide. Many consumers initiate quotes early, pause, return weeks later, and re-evaluate before binding.

This pattern explains why early-2026 activity includes a surge in auto insurance leads that behave differently than traditional seasonal demand. The same consumer may appear multiple times across channels, devices, and sessions, reflecting layered intent rather than duplication.

For carriers, the challenge is not demand generation. It is intent interpretation.

5. Early-Year Spikes Are Stress-Testing Lead Quality and Distribution Efficiency

Periods of elevated shopping magnify weaknesses in the acquisition strategy. Early-2026 intent spikes include a mix of exploratory shoppers, price validators, and ready-to-bind consumers. Without clear qualification, this volume can overwhelm sales operations and dilute conversion rates.

This is why carriers are increasingly prioritizing verified insurance leads that surface intent signals, accurate data, and timing context. Lead quality now directly affects agent productivity, speed-to-contact performance, and overall acquisition efficiency, especially during high-intent windows like early Q1.

As auto insurance shopping becomes more frequent and more complex, QuoteNest supports carriers by delivering verified insurance leads designed around real consumer intent, accurate data, and transparent sourcing. By aligning demand signals with carrier appetite and distribution readiness, QuoteNest helps carriers turn early-year intent into measurable outcomes, not just higher traffic.

What This Means for Carriers Entering 2026

Auto insurance shopping behavior is changing in meaningful ways. Shifts in vehicle risk, pricing dynamics, and consumer expectations are reshaping how demand enters the market. Carriers that approach this activity as a volume play risk misallocating resources, while those that treat it as a signal shift are better positioned to convert demand efficiently and protect long-term profitability.