Insurance carriers continue to invest heavily in digital acquisition, yet a familiar challenge persists across lines of business: a significant share of insurance shoppers disengage after the first agent call. This behavior is often attributed to low intent or poor lead quality. In reality, it reflects how insurance buying behavior, expectations and timing have evolved.

Today’s shoppers are more informed, more cautious and more selective about when and how they engage. Many initiate quote activity to compare pricing logic, coverage options, and carrier credibility before they are ready to bind. When outreach does not align with that mindset, disengagement follows.

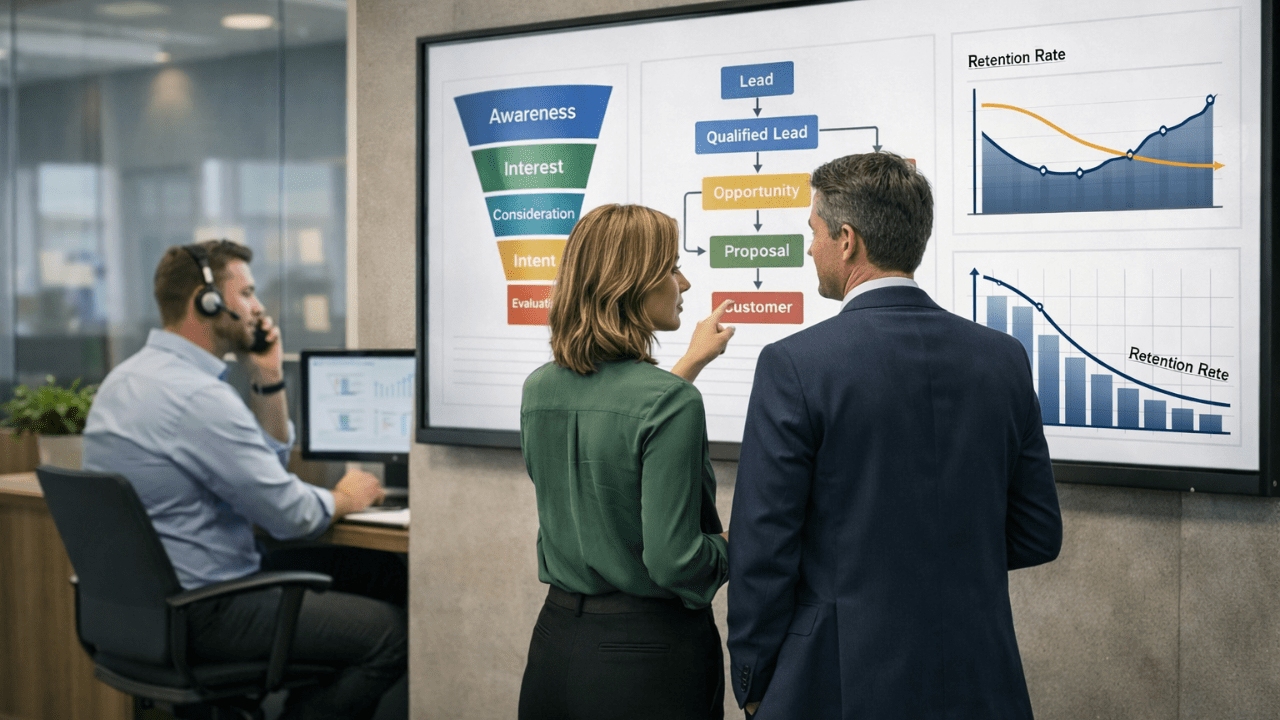

For carriers, the challenge is not demand generation. It is insurance leads management, interpreting intent correctly and engaging it at the right moment.

1. Silent Abandonment Is Common in High-Consideration Purchases

Insurance is a high-stakes, high-consideration decision. Research on customer interaction behavior shows that a large portion of consumers disengage silently rather than explicitly opting out. In some service categories, up to 71% of customers abandon without explanation, leaving businesses unsure whether interest was lost or simply deferred.

For carriers, non-response after a first call should not automatically be treated as rejection. In many cases, the shopper has paused the process because the interaction did not yet match their decision timeline.

2. Timing Gaps Cause Intent to Decay Faster Than Expected

Intent decays quickly in insurance shopping. Industry response benchmarks show that engagement probability drops sharply when initial contact is delayed, with significant declines occurring within the first 30 minutes after lead submission.

At the same time, speed alone is not enough. A fast call without context can feel intrusive, while a delayed call can arrive after the shopper has mentally moved on. The challenge for carriers is balancing responsiveness with relevance.

3. Early Calls Are About Validation, Not Conversion

Most insurance shoppers treat the first interaction as a validation step. They are assessing whether pricing makes sense, whether coverage structures align with their needs, and whether the carrier feels credible enough to continue engaging.

When the first call assumes immediate buying readiness, friction is introduced. Shoppers who are still comparing options often disengage quietly rather than push back. This is frequently misclassified as low-quality demand when it is more accurately early-stage intent approached too aggressively.

Carriers that perform better use the first call to clarify, not close. Aligning on expectations early improves downstream engagement and conversion efficiency.

4. Trust Signals and Signal Quality Shape Responsiveness

Call screening behavior has increased significantly across insurance categories. Shoppers are more cautious about answering unknown numbers, especially when they have requested quotes from multiple sources.

When calls feel repetitive, unexpected, or disconnected from the shopper’s actual inquiry, response rates decline regardless of underlying interest. This is where signal quality matters. Carriers benefit most when outreach is driven by a structured context of what the shopper has already evaluated, how ready they are, and why the call is relevant. This is where QuoteNest fits into insurance marketing solutions. By focusing on validated demand signals and readiness indicators upstream, carriers are able to start conversations that feel timely and purposeful rather than redundant.

5. Silence Is a Signal, Not a Loss

Many carriers lack visibility into what happens after the first call. Missed callbacks and stalled conversations are often treated as attrition rather than insight.

In practice, silence usually signals misalignment between timing, expectations, or engagement approach. Shoppers rarely abandon the buying process entirely after one interaction. More often, they disengage temporarily because the conversation did not match where they were in their decision journey.

Recognizing silence as feedback, rather than failure, allows carriers to refine outreach strategies and improve long-term conversion rates.

What This Means for Carriers

Insurance shoppers who stop responding after the first call are rarely making a definitive decision. More often, they are signalling that the interaction did not align with where they are in the buying journey.

As insurance shopping becomes more iterative and comparison-driven, carriers that interpret silence as a signal rather than a failure are better positioned to convert demand efficiently. This requires clearer intent visibility, better first-call alignment, and acquisition strategies that prioritize quality over raw volume.