Winter weather in the United States may be predictable, but the losses it generates often are not, and that uncertainty has real consequences for home insurers. According to the National Oceanic and Atmospheric Administration, weather and climate disasters causing more than one billion dollars in damage have become far more frequent in recent years. In 2024 alone, the United States experienced 27 separate weather and climate disasters with losses exceeding one billion dollars each. These events included severe storms, flooding, wildfires, and winter-related perils, reflecting the broader volatility insurers now face across risk categories.

For carriers, winter losses are rarely isolated incidents. They expose how well risk assumptions, coverage understanding, operational readiness, and customer expectations hold up when conditions deteriorate.

Source: NOAA

Winter Loss Patterns Are More Complex Than They Appear

Winter losses rarely arrive as a single moment of damage. More often, they build gradually through extended cold, freeze and thaw cycles, infrastructure stress and delayed mitigation. Pipes may freeze only after days of exposure. Ice dams can form slowly and allow water to seep into walls and ceilings. Power outages extend damage windows and delay response.

For insurers, this pattern makes winter losses harder to model and manage. Damage that accumulates over time challenges traditional assumptions around frequency and severity. Carriers that rely on simple seasonal expectations often find that losses escalate quietly before they are fully visible.

Water Damage Drives the Most Severe Winter Claims

While snowfall and ice receive the most attention, water damage is the primary driver of winter claim severity. Frozen pipes, gradual leaks, ice dam backflow, and basement seepage frequently lead to extensive structural damage. These losses are costly because they trigger mitigation work, mold prevention, temporary housing, and extended repair timelines. From a carrier perspective, water-driven winter claims create both cost and communication challenges. Claims involving gradual damage often sit in grey areas of coverage interpretation. When homeowners expect all winter-related damage to be covered, dissatisfaction rises even when policy language is applied correctly. These moments test not just claims handling but customer trust.

Coverage Expectations Break Down Under Winter Stress

Winter claims are often the point at which homeowners discover gaps between what they believed was covered and what their policy actually includes. Many assume weather-related damage is broadly covered, without understanding exclusions tied to flood, maintenance, or slow seepage.

This disconnect is especially visible among homeowners shopping for affordable home insurance, where price sensitivity can outweigh deeper consideration of coverage limits and exclusions. When winter losses occur, frustration tends to stem less from claim outcomes and more from unmet expectations set earlier in the buying journey. For insurers, these breakdowns highlight that many winter claim disputes are rooted in acquisition and onboarding, not claims execution.

Operational Surges Create Secondary Loss Pressure

Winter weather often affects large regions at once, creating sudden spikes in claims volume. Adjuster availability, vendor networks, and call centres can all become strained simultaneously. Even valid claims can feel mishandled if inspections are delayed or communication is inconsistent.

From the policyholder perspective, the experience is shaped by responsiveness as much as by settlement. From the carrier perspective, winter events reveal how quickly operational inefficiencies can amplify loss costs and damage retention. Insurers that prepare for surge conditions preserve trust even when claim volumes rise sharply.

Winter Losses Expose Gaps in Acquisition and Lead Context

Winter conditions often prompt homeowners to reassess coverage or explore new policies. However, not all inbound demand reflects the same intent. Some homeowners are responding to recent damage, others to renewal pricing, and others are simply seeking reassurance.

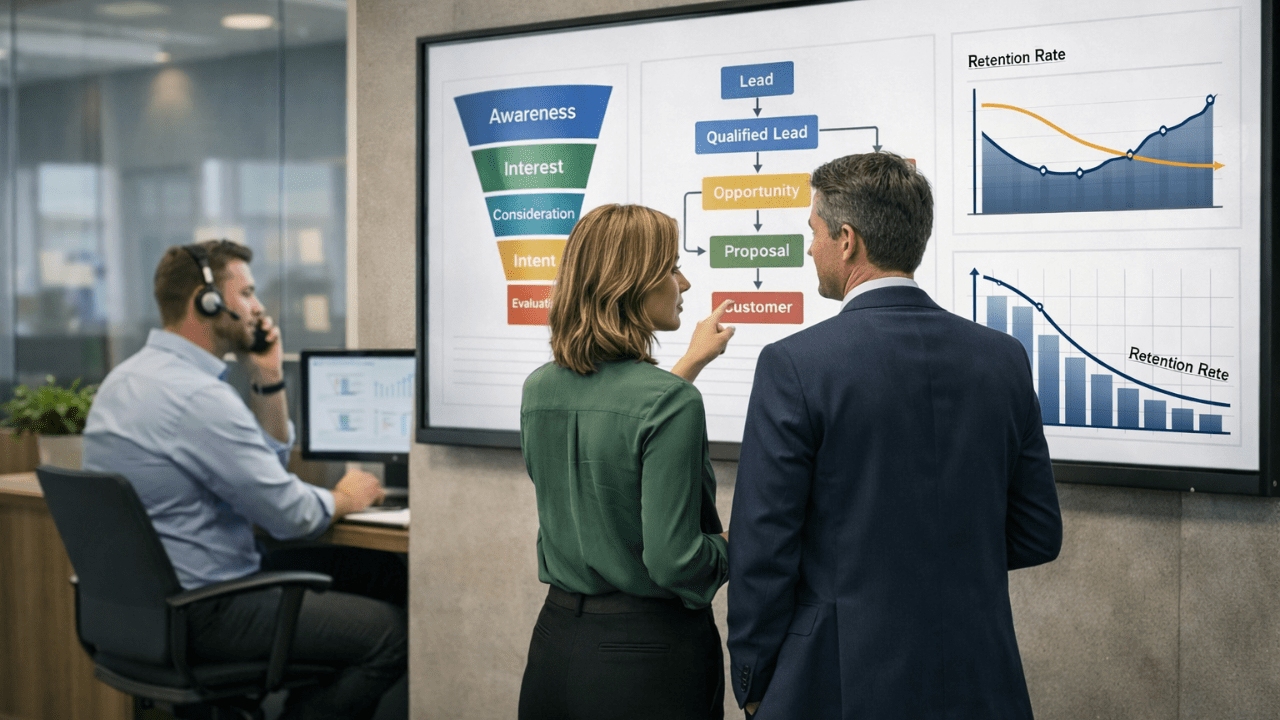

Without clear context, agents are forced to interpret readiness during the conversation itself, increasing the risk of misalignment. Strong insurance lead management helps carriers distinguish between exploratory interest and coverage-driven urgency, enabling more relevant and productive engagement.

This is where insurance marketing solutions are evolving, with a greater emphasis on intent clarity and contextual signals rather than volume alone. QuoteNest supports by surfacing homeowner intent and context earlier in the journey, allowing coverage conversations to happen before winter losses expose misunderstandings.

What This Means for Home Insurers

Winter losses do not catch insurers off guard because winter itself is unpredictable. They do so because small misalignments across coverage understanding, operational readiness and acquisition quality compound under stress.

Carriers that navigate winter cycles more effectively focus on setting clear coverage expectations at the point of sale, stress testing claims operations before peak volume arrives, and aligning acquisition strategies with real homeowner intent and context.

Winter will always be a season of elevated risk. Whether it becomes a season of churn or a season of reinforced trust depends on how well insurers prepare long before the temperature drops.