Insurance shoppers today behave less like passive buyers and more like analysts. Recent market reporting shows that 57% of auto insurance customers shopped in 2025, with nearly three in ten switching providers(Insurance Journal). The comparison mindset is no longer episodic; it is the default.

For carriers, this changes what lead buying actually means. In a comparison-heavy market, acquisition is no longer a volume exercise. It is a performance decision that shapes conversion rates, agent productivity and how efficiently marketing spend turns into issued policies.

This is where AI has become a practical advantage inside modern lead programs. Not because it “automates marketing,” but because it makes reliability measurable. A few years ago, programs were evaluated primarily on surface indicators such as cost per lead, connect rate, or delivery speed into the CRM. Those signals still matter, but they no longer explain what carriers ultimately need: more issued policies per dollar spent, with stronger consent posture and fewer unproductive agent touches.

AI shifts lead buying from a transactional activity into conversion infrastructure especially when paired with disciplined insurance marketing solutions and outcome-driven digital marketing for insurance services.

1) Lead quality becomes lead confidence

Lead quality used to be assessed retrospectively. Agent feedback came in after the fact, marketing reviewed performance reports and partners explained variance. AI changes that dynamic by allowing carriers to define quality upfront and apply it consistently.

Rather than asking whether a lead “looks good,” carriers can evaluate confidence across the dimensions that actually influence conversion: identity confidence and contactability, intent strength, quote readiness and compliance readiness. When these factors are scored before the lead enters the sales motion, quality becomes enforceable instead of subjective.

That shift is a direct ROI lever. It reduces re-qualification effort, stabilises downstream conversion and limits the noise that agents have to work through. In an insurance comparison platform-driven environment where shoppers move quickly between providers and expect immediate relevance, AI helps carriers prioritise leads that behave like real opportunities, not just completed forms.

2) Verification first, then velocity

Speed-to-lead only delivers value when the lead is actually workable. Many carriers see their earliest performance lift when AI is applied to verification, because it improves the reliability of what enters the funnel.

Verification today goes beyond confirming whether a phone number exists. It evaluates whether a prospect is likely to progress without excessive back-and-forth, based on consistency across behavioural and data signals. Pattern-based validation, integrity scoring and behavioural markers help determine how confidently a lead can be worked.

The operational impact is straightforward: agents spend more time quoting and advising and less time sorting, re-checking, or chasing dead ends. For carriers focused on verified insurance leads, verification becomes the gate that protects both productivity and customer experience. It also improves brand perception, because the first touch feels informed and timely rather than generic or repetitive.

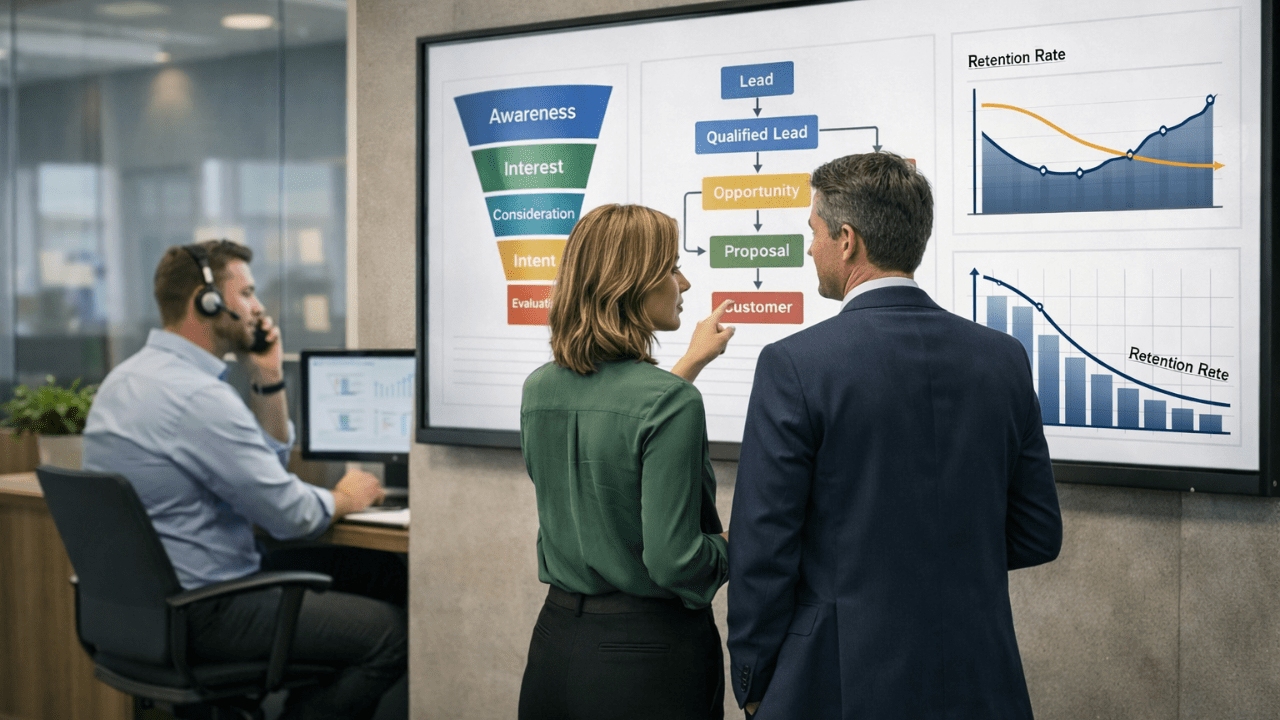

3) Intent scoring that identifies readiness

One of the most persistent misconceptions in lead buying is that all form-fills represent the same level of readiness. In reality, many shoppers are still evaluating trade-offs even after they submit details.

AI makes intent operational by separating prospects based on where they sit in the decision cycle. Some are ready to engage immediately. Others are comparing options and need context. Some are earlier-stage and respond better to structured nurture rather than aggressive outreach.

This distinction is where AI improves both lead quality and ROI at the same time. When outreach is prioritised based on likelihood to quote and likelihood to bind, intent stops being a vague signal and becomes a measurable performance input. The objective is not to discard early-stage demand, but to route it appropriately so ready-to-bind shoppers receive priority, while earlier-stage prospects remain engaged without exhausting agent capacity.

This separation defines the difference between programs that generate activity and those that generate predictable outcomes.

4) Routing protects agent time & stabilises conversion

Licensed, high-performing agents are a finite resource. Their time is the most expensive input in the acquisition engine, which is why routing has become a critical performance lever.

AI-led routing replaces simple speed-to-lead logic with best-moment-to-contact decisioning. It determines which leads should be worked first, which team is best suited to handle them and which channel sequence is most likely to result in a productive conversation.

When routing is driven by conversion probability and fit, outcomes rely less on manual triage. Quote completion becomes more consistent across teams. Contact attempts become more efficient. The same lead volume produces better output because decisions are being made dynamically, in real time.

This is why lead quality is no longer only a marketing concern. It is a sales operations metric and AI increasingly acts as the connective layer between acquisition and execution.

5) ROI you can defend with closed-loop outcomes

ROI cannot stop at cost per lead. Sustainable performance is measured through cost per issued policy, quote-to-bind rate and the long-term quality of customers acquired.

AI strengthens ROI when it enables closed-loop measurement linking lead attributes and sources directly to quote and bind outcomes, then feeding those insights back into sourcing, scoring and routing decisions. That feedback loop turns lead buying into a system rather than a sequence of monthly optimisations.

It also changes how carriers evaluate partners. The most valuable partners are not those who simply deliver volume, but those that support structured qualification, transparent sourcing and continuous performance refinement tied to outcomes. This is where platforms designed around verified insurance leads and measurable conversion readiness such as QuoteNest fit naturally for carriers seeking predictable performance rather than short-term spikes.

Conclusion

AI is reshaping insurance lead quality and ROI by making reliability scalable. In a market defined by constant comparison and sustained shopping activity, carriers need more than volume. They need lead confidence, verification discipline, intent-based prioritisation, routing that protects agent productivity and ROI measurement anchored to issued policies.

When these elements work together, digital marketing for insurance services becomes more accountable and lead buying evolves into a smarter acquisition engine that improves year after year.