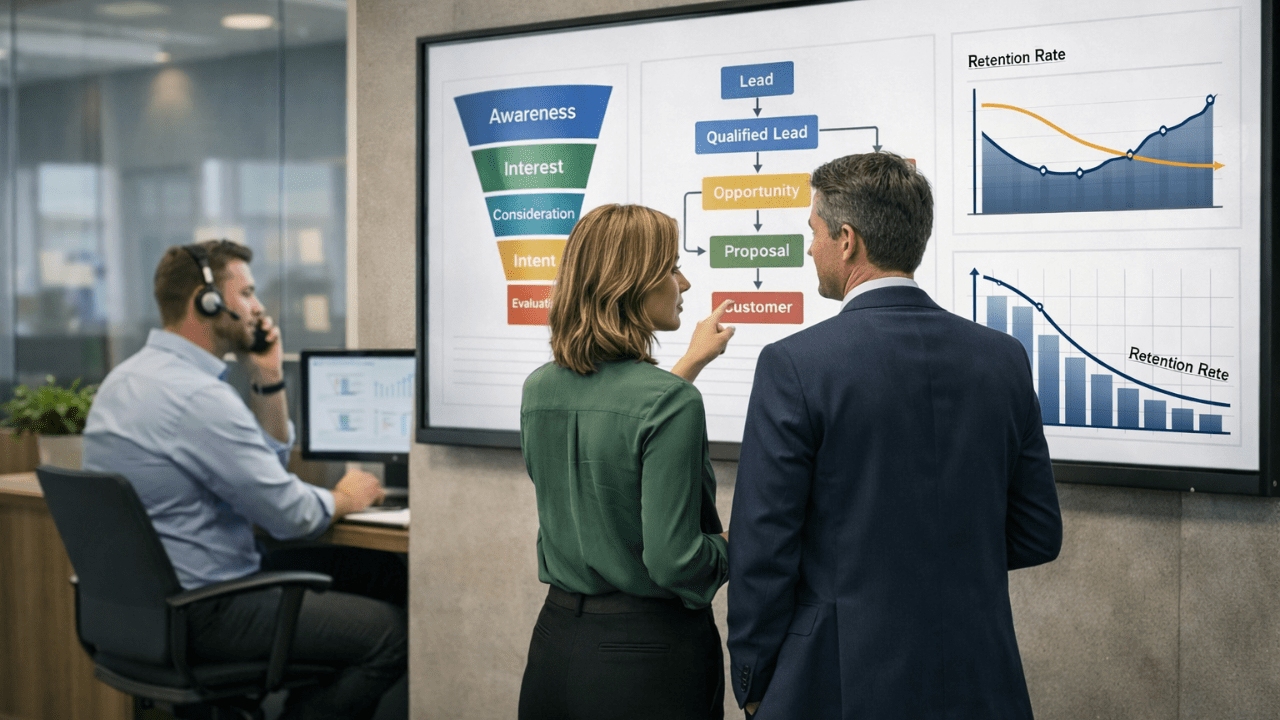

Home insurance demand follows clear patterns across the year, shaped by deadlines, renewals, regional risk and eligibility constraints. Each period brings a different reason for shopping and a different level of readiness to convert.

For carriers, this means seasonality is less about volume swings and more about intent shifts. When qualification, routing, and follow-up reflect what the shopper is trying to resolve in that moment, conversion improves and agent effort stays focused. Treating every month with the same lead strategy forces multiple decision states through a single motion, creating friction that slows binding and wastes time.

Let’s break down home insurance seasonality into intent modes to outline how carriers can align acquisition and engagement to turn demand into measurable outcomes.

1) Deadline Mode: purchase timelines create bind-ready demand

When shopping is driven by a closing or move date, the shopper acts out of requirement. Carriers should treat this season as a speed-and-precision window. The highest-impact move is making intake quote-ready upfront so agents don’t spend the first interaction re-collecting property basics. Routing also matters more than ever here. Get these leads to the right team immediately, because the shopper will choose the carrier that makes the process easiest to finish.

2) Renewal Mode: premium and renewal timing drive comparison behavior

This stage is all about evaluation. The shopper is deciding whether switching is worth it. Carriers convert this season by reducing friction and increasing clarity. Follow-up needs to reflect the shopper’s context and quoting needs to be clean enough that the customer doesn’t feel like they’re starting over. On an insurance comparison platform, this is where carriers win by making tradeoffs simple, deductible choices clear and the path to bind feel low-effort.

3) Risk Mode: storm season shifts intent from price to coverage confidence

In risk-led seasons, the shopper’s primary question isn’t “what’s cheapest.” It’s “what actually protects me.” Carriers should adjust the sales motion accordingly. This is the moment to prioritize coverage clarity, route leads to teams that can explain terms confidently and ensure the experience answers seasonal questions without delays. The conversion lift comes from removing uncertainty quickly. When shoppers feel informed, they move.

4) Eligibility Mode: wildfire periods make the underwriting-fit part of the conversion

When availability tightens in certain regions, shoppers often enter the journey wondering if they can even get covered. That makes underwriting-fit a conversion factor. Carriers should use smarter qualification here, not broader targeting. Capture the property and location attributes that determine eligibility earlier, align acquisition to appetite and route edge cases to the right workflow before time is wasted. The win in this mode is fewer mid-quote surprises and fewer leads that consume effort without a realistic path to bind.

5) Protection Mode: winter damage concerns create “act now” shoppers

This is the most immediate intent mode. Shoppers are reacting to a risk they can picture clearly. Carriers convert this season with calm speed. The best programs simplify the next step, collect the right details upfront and follow up in a way that feels helpful rather than generic. When the experience reduces stress and moves fast, conversion improves because the shopper is trying to resolve uncertainty quickly.

Conclusion

Seasonality isn’t a calendar insight. It’s a conversion strategy. Each season creates a different shopper intent mode and carriers that match sourcing, qualification, routing and messaging to that mode get better outcomes from the same lead volume. Done well, this approach produces more verified insurance leads, better agent productivity and stronger cost per issued policy through digital marketing for insurance services. It’s also where a performance-led partner like QuoteNest can help carriers align intent-driven demand on an insurance comparison platform with the delivery structure that converts.