Insurance growth is getting “harder” for a simple reason. The market now penalizes short-term tactics. Premium pressure, volatility and higher customer expectations mean growth has to be engineered as a system, not chased as a campaign.

The cost environment makes this real. Analysis shows home insurance premiums rose faster than inflation over recent years, with significant variation by region. On the distribution side, Matic reports the average premium for new home policies is $1,966, up 9.3% from 2024, following an 18.8% increase from 2023 to 2024.

When pricing and shopper behavior stay dynamic, the carriers that win are the ones that build growth systems that keep working through cycles.

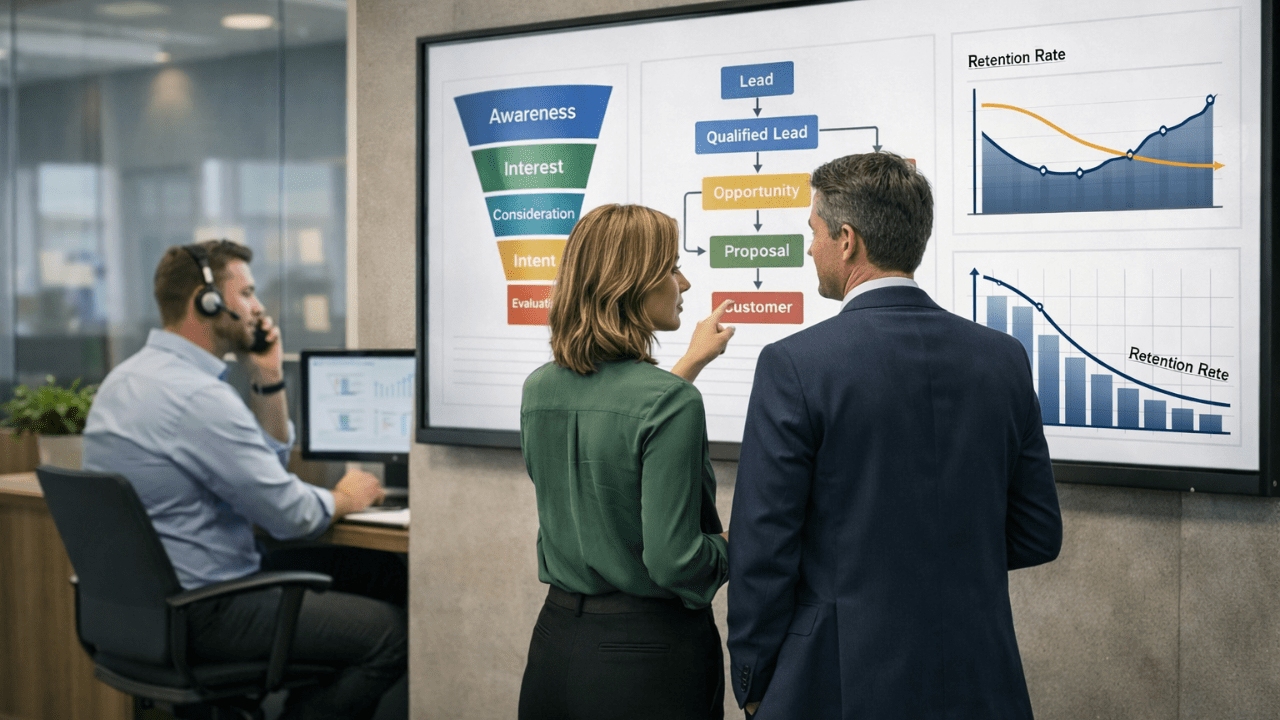

1. Retention is your first growth channel

A lasting growth system starts with a blunt truth. The cheapest customer is the one you do not have to replace.

Customer mobility is high: 27% of personal line policyholders switched providers after two years, with switching driven mainly by lower premiums and better coverage.

For carriers, this changes the growth playbook. Growth is not only about acquiring more. It is about reducing replacement demand caused by churn. The system needs built-in retention levers early, like coverage clarity at purchase, proactive renewal education, and fewer surprise moments. If customers leave because the experience felt misaligned, no amount of acquisition fixes the underlying leak.

2. Start buying outcomes

Many growth plans still celebrate lead volume or quote starts. Durable growth systems measure what matters to profitability.

High customer acquisition costs and low margins make growth harder to sustain unless distribution becomes more efficient and customer experience improves.

For carriers, this means your system cannot stop at cost per lead. It must measure through conversion efficiency and early tenure stability. This is where Insurance leads management becomes a structural advantage. When leads arrive with clearer intent and context, agents spend more time advising and less time filtering. That improves bind rates and protects capacity.

QuoteNest acts as a volume lever but also as a way to bring stronger intent cues and cleaner journey context into your funnel so the same team produces more high-quality binds.

3. Treat distribution like a product

Growth systems that last treat the buyer journey as something you design, not something you react to.

The digitizing journeys should not be only about cost-cutting, and that true digital leadership requires stronger service and personalization, not thinner experiences.

Carrier relevance is simple. Shoppers do not experience your org chart. They experience your journey. If your system is fragmented, sales feels disconnected from underwriting, and servicing feels disconnected from what was promised at bind. Over time that weakens trust, increases servicing friction, and raises churn risk.

A durable system standardizes how customers move from first intent to the right path, whether that is agent led, assisted digital, or digital bind. That is what modern insurance marketing solutions should enable: fewer dead ends, fewer handoff losses, and more consistent conversion.

4. Make affordability a system outcome

In home insurance especially, affordability is now central to growth narratives, but the way you approach it matters.

The Treasury report shows how rapidly costs have risen and how unevenly they hit consumers across locations. Matic’s new policy pricing trend reinforces that premiums remain elevated even as the pace of increases changes.

For carriers, this is where many growth plans fail. They try to win affordable home insurance demand purely on price, and then the book destabilizes with retention pressure later. A lasting system wins affordability through better fit, clearer coverage expectations, and fewer misunderstanding-driven cancellations.

This is another place QuoteNest is woven in credibly. When the funnel captures why a homeowner is shopping and what they actually need, carriers can steer conversations toward the right coverage structure early, instead of forcing every shopper into the same quote and close motion.

5. Build the monthly feedback loop that compounds improvement

Campaigns repeat. Systems learn.

A growth system that lasts connects acquisition signals to what happens after bind, not just before it. That means consistently linking:

- Lead intent and context

- Sales outcomes and agent touch patterns

- Underwriting results and pricing fit

- Service friction and claim experience cues

- Renewal behavior and churn reasons

Carrier relevance is that this loop turns growth into a learning engine. If a segment binds well but churns early, the system adapts the targeting and expectation setting. If a channel produces volume but low contact quality, the system adjusts routing and messaging. This is what makes growth durable even when the market shifts.

Conclusion

Building insurance growth systems that last is less about chasing the next channel and more about engineering reliability across the full customer lifecycle. The carriers that win will be the ones that protect retention, improve conversion efficiency, design journeys that feel coherent and run a feedback loop that keeps improving decisions.