The insurance industry is entering a more disciplined phase of growth. Customer acquisition costs are rising across channels, digital competition is intensifying, and insurance buyers are taking longer to make decisions while expecting faster, more relevant engagement once they do. These shifts are forcing carriers to rethink how they approach demand generation, sales efficiency and insurance marketing solutions.

In this environment, buying insurance leads is no longer a volume-driven exercise. It has become a performance decision that directly influences conversion rates, agent productivity, and long-term profitability. Carriers that want to succeed in 2026 need to invest in the right leads, at the right moment, supported by the right qualification and delivery structure across their lead generation digital marketing efforts.

Below are the core strategies shaping how leading insurance carriers are rethinking insurance lead buying this year.

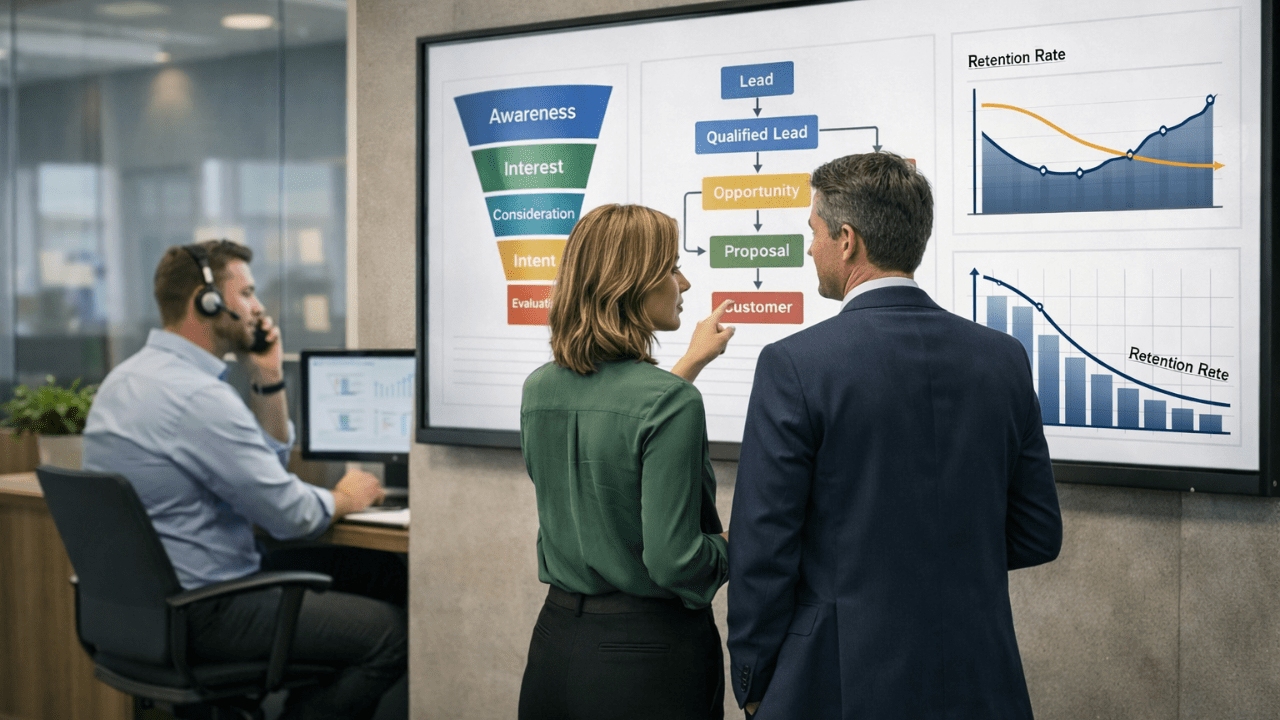

Prioritize Intent Signals Over Raw Lead Volume

Insurance buyers today behave very differently than they did even five years ago. Most insurance shoppers now evaluate multiple providers and spend significant time researching before submitting their details.

This has made raw lead volume a poor proxy for opportunity.

High-performing carriers are shifting their focus from how many leads they receive to how ready those leads are to engage. Verified insurance leads that reflect active comparison behavior, clear coverage interest and an expectation of follow-up convert at meaningfully higher rates than casual or incentivized form fills.

The practical takeaway is simple: intent must be identified before a lead reaches an agent. When intent filtering happens upstream, carriers see better contact rates, shorter sales cycles, and a lower cost per bind.

Align Lead Buying With Agent Capacity and Sales Operations

Lead quality is no longer just a marketing metric. It is an operational one.

According to Bain & Company, agent productivity is one of the strongest predictors of profitable growth in insurance. When agents spend excessive time qualifying weak leads, overall efficiency drops, even if lead volume increases.

This is why carriers are re-evaluating lead buying through an operational lens. Speed of delivery, data accuracy, and contextual information now matter as much as price.Leads delivered in real time, with validated contact details such as users seeking and basic qualification context, consistently outperform delayed or poorly structured leads. They allow agents to focus on advising rather than filtering, which improves both performance and morale.

Treat Lead Quality as a Compliance and Risk Consideration

As regulatory scrutiny increases, carriers are paying closer attention to how leads are sourced and delivered.

Research from Deloitte highlights that consent clarity, data accuracy, and transparency in customer acquisition are becoming material risk factors for insurers. Poorly sourced leads can expose carriers to reputational damage, compliance issues, and erosion of customer trust.

In 2026, carriers are increasingly favouring insurance lead management that emphasises clear user intent, explicit consent, and transparent sourcing. This not only protects the business but also improves downstream engagement, as customers are more receptive when expectations are set correctly.

Lead buying has become part of the risk and governance conversation, not just a growth discussion.

Integrate Lead Buying With Retention and Lifetime Value Goals

Insurance acquisition does not end at the first policy sale.

Carriers are increasingly evaluating lead sourcing strategies based on the quality of customers they attract, not just initial conversions. Leads that convert cleanly, understand the product, and engage with advisors tend to have higher retention and lifetime value.

In 2026, forward-looking carriers are connecting lead strategy with broader customer value metrics, including renewals, cross-sell potential, and service engagement.

When lead buying supports long-term customer quality, it strengthens both growth and profitability.

Build Long-Term Lead Partnerships, Not Transactional Supply

As lead strategies mature, carriers are moving away from short-term purchasing toward long-term performance partnerships.

Rather than constantly switching vendors, they work with platforms that support continuous optimization, adapt to changing buyer behavior, and align incentives around quality and outcomes.

This is typically the stage where carriers evaluate solutions that emphasize intent-driven sourcing, structured qualification, and ongoing performance refinement. QuoteNest is one such platform, designed for carriers seeking predictable performance rather than short-term volume spikes.

The key is alignment. When lead partners are accountable for outcomes, not just delivery, results improve over time.

How Winning Carriers Will Approach Lead Buying in 2026

- Focus on intent, not just traffic

- Protect agent time and productivity

- Demand transparency and compliance

- Measure success by outcomes, not inputs

Buying insurance leads is now about building a smarter, more accountable acquisition engine that supports growth year after year.

Carriers that make this shift will not only acquire customers more efficiently but also build a competitive advantage that compounds over time.