Price sensitivity is changing how insurance decisions behave in the real world. It is pushing shoppers to look harder for a lower premium. Quote journeys are starting earlier, comparisons are happening simultaneously across multiple providers, and exits occur faster when clarity or confidence drops. For carriers, that creates a chaotic funnel with more lookalike demand mixed into fewer truly ready buyers. But even with price pressure, shopping does not cool down. TransUnion reported auto shopping has increased by 18 percent year over year in Q2 2025 and home shopping by 9 percent, which signals how active the market remains. The reason is persistence. Consumers continue to re-enter the decision cycle until pricing, coverage, and trade-offs align with a sense of security and control.

1) Price sensitivity makes shopping faster and less patient

When price pressure rises, shoppers come in with one goal first: reduce the bill. But they also come in with lower tolerance for slow steps, vague answers, or follow up that feels generic. The moment they sense friction, they move to the next tab, the next form, the next carrier. That is why funnels feel more jumpy in a price sensitive market. It is not that shoppers are irrational. It is that they are trying to get to a credible answer before they spend more time. Carriers that simplify early steps and give quick clarity keep more of this demand in motion instead of losing it back to the comparison set.

2) Shoppers want a lower premium, but they do not want risky shortcuts

Price sensitive shoppers are not only asking, “Can this be cheaper?” They are also silently asking, “What am I giving up if it is cheaper?” They worry about making a decision that backfires through higher deductibles, weaker coverage, missed discounts, or another surprise increase. So a quote number alone does not feel like progress if it arrives without context. The journeys that convert best in this environment make tradeoffs understandable in plain language, early enough that shoppers feel in control. When the experience reduces confusion, shoppers stop treating every quote like a temporary answer and start treating it like a decision.

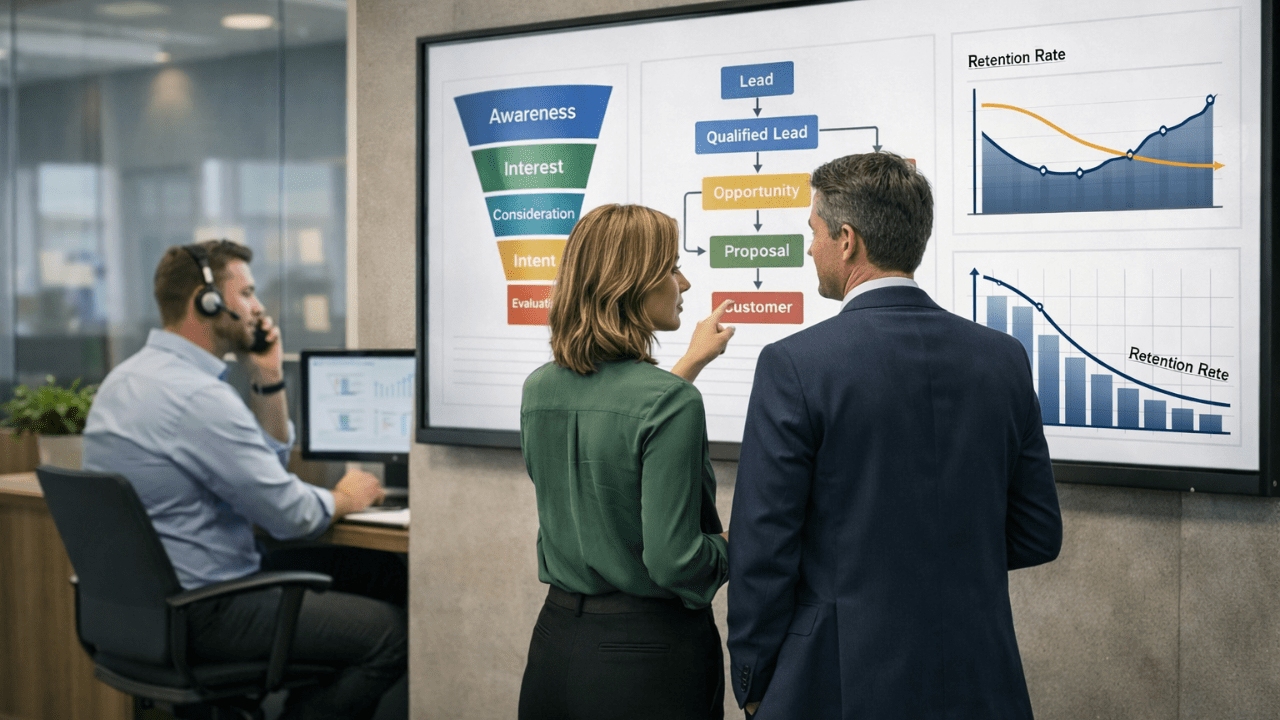

3) Price sensitivity splits intent into three lanes

In a high shopping market, many quote requests look similar, but the intent behind them is not the same. This is where conversion economics gets won or lost.

1. Rate checkers

They are benchmarking and validating their current price. They often create activity without being ready to switch.

2. Rebalancers

They want relief through options like deductible changes, coverage adjustments, bundling, or payment choices. They respond best to guided tradeoffs.

3. Switch ready shoppers

They are in a real buying window and convert when they get a credible answer quickly and the journey feels trustworthy.

4) Misrouting becomes the biggest conversion leak

When more shoppers enter the funnel, the easiest mistake is treating all demand as equally ready. That floods agents with rate checkers, while switch-ready shoppers get stuck in slow or irrelevant paths and disappear. The cost is not only lost binds. It is wasted human time and a rising acquisition cost per policy. Shopping strength is also heavily driven by consumers with lower credit-based insurance scores, which fits the pattern of higher sensitivity to rate changes and more aggressive shopping behavior.

This is exactly where lead context and readiness signals matter. For carriers investing in lead acquisition, insurance lead management becomes a real growth lever, because the advantage lies in the ability to identify readiness and route the right shoppers to the right path. Verified insurance leads reduce dead-end follow-ups and preserve agent productivity by prioritising readiness over raw volume. That focus defines the conversion lane QuoteNest is built to support.

5) Renewal starts behaving more like a decision moment

Price sensitivity does not stop after acquisition. It reshapes retention because renewal is now easier to question. A premium change that is not explained clearly reads like unpredictability, and unpredictability triggers shoppers to check alternatives even when service has been fine. In this market, retention improves when carriers reduce uncertainty before customers feel forced to shop. When the renewal experience explains what changed and surfaces realistic options, customers are less likely to go searching for clarity elsewhere. The goal is not to prevent every shopper from comparing. The goal is to keep your customer from feeling they have to compare to understand their own policy.

Where this is heading

Price sensitivity is making insurance shopping more active, fragmented and efficiency driven. It expands the funnel, but it also blurs intent, so conversion becomes less about chasing volume and more about guiding decisions. The carriers that win will be the ones that make the quote journey feel clear and controlled, route effort based on readiness and protect agent time for the shoppers who are truly in market. When shoppers feel they can reach a confident decision quickly, price stops being the only story and becomes one input in a decision they trust.